Sustainability Management

Materiality Issues

Materiality issues at Aisin

Aisin has pursued sustainability management in accordance with materiality elements selected in FY2020, but in January 2025, we assessed our materiality program to accommodate changing business conditions and social demands.

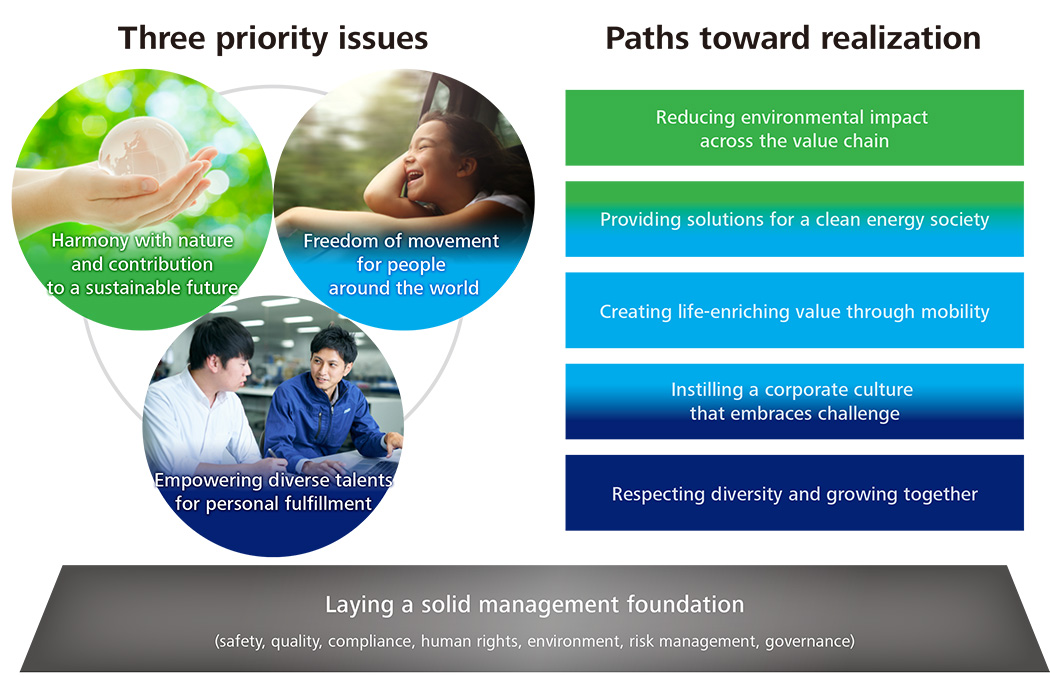

In defining our materiality posture, we have identified three priority issues and five paths to achieving them. We will work to resolve these issues in the course of our business activities.

Materiality assessment process

To apply our management philosophy in the real world, we have defined issues that Aisin must address in the context of the long-term business environment and positioned them as materiality issues.

In assessing materiality issues, we from employees to executives, reaffirm the essence of our management philosophy, view it against current social issues, and select topics that the Company should prioritize. The process for identifying materiality issues is as follows.

| Issue extraction | STEP1 | Catalog general business and ESG-related issues Reference guidelines and disclosure standards: ESRS, ISSB, SASB, GRI, etc. |

|---|---|---|

| Prioritize | STEP2 | Conduct employee workshops to extract issues related to Aisin's business activities |

| STEP3 | Narrow down key management issues through workshops for executives (including outside directors) | |

| Engage stakeholder (Investors, external experts, local residents, suppliers, employees, etc.) |

STEP4 | Validate the materiality issues draft |

| Identify materiality issues | STEP5 | Discuss and resolve the materiality issues draft at the Sustainability Conference; report to the Board of Directors and obtain approval. |

Risks and opportunities

In identifying materiality issues, we analyze and evaluate risks and opportunities for Aisin based on internal and external environmental changes.

Assessment conclusions are as follows.

| External environment | Risks and opportunities for Aisin | Materiality issues | |

|---|---|---|---|

| Priority Issues | Paths toward realization | ||

| Politics | Risks |

Harmony with nature and contribution to a sustainable future Freedom of movement for people around the world Empowering diverse talents for personal fulfillment |

Reducing environmental impact across the value chain Providing solutions for a clean energy society Creating life-enriching value through mobility Instilling a corporate culture that embraces challenge Respecting diversity and growing together |

|

|

||

| Economic conditions | |||

|

|||

| Society | Opportunities | ||

|

|

||

| Technology | |||

|

Laying a solid management foundation (safety, quality, compliance, human rights, environment, risk management, governance) |

||

Risks related to sustainability are integrated into our companywide enterprise risk management (ERM). For details on specific risks and responses, please refer to the Risk Management section of this website. Furthermore, opportunities related to sustainability are deliberated at various key meetings and management meetings. Significant opportunities are submitted to and reported to the Board of Directors.

Materiality issues: key goal and performance indicators

We set key goal indicators (KGI) and key performance indicators (KPI) for materiality issues that are approved by the Board of Directors and forged into specific action plans for implementation.

| Priority issues | Paths toward realization | Goal (KGI) | Indicator (KPI) | FY2031 target values | Scope | Targeted SDGs |

|---|---|---|---|---|---|---|

| Harmony with nature and contribution to a sustainable future | Reducing environmental impact across the value chain | [Carbon neutrality] Carbon neutrality by FY2051 Carbon-neutral in-house manufacturing by FY2036 |

Scope 1 & 2 emissions | 46.2% decrease compared to FY2020 |

Consolidated |

|

| Scope 3 reduction | 27.5% decrease compared to FY2020 |

|||||

| [Circular economy] Achieve zero-emission plant by FY2041 (landfill waste: 1% or less) |

Optimizing resource utilization | 10% efficiency improvement*1 | ||||

| Waste minimization Waste emissions | 11% decrease compared to FY2020 |

|||||

| Providing solutions for a clean energy society | Widespread use of cleantech*2 products and services in the mobility and energy domains | CO2 emission reduction via products and services *3 | 20 million t-CO2*4 |

|

||

| Freedom of movement for people around the world | Number of cleantech products commercialized | Three or more | ||||

| Creating life-enriching value through mobility | Realizing safe, reliable, comfortable and convenient mobility | Number of drive units sold *5 (cumulative since 1969) | 270 million |

|

||

| Number of newly adopted products and services (cumulative since 2025) | 500 | |||||

| Build-out of aftermarket product and service lineup Number of Product and Service Categories |

100 or more | |||||

| Total users of mobility-related services (MAU *6) | 183,400 | |||||

| Number of key new business domains | 3 domains | |||||

| Instilling a corporate culture that embraces challenge | Ongoing accumulation of new fundamental technologies | Number of inventions*7 | 1,500 |

|

||

| Environment conducive to a proactive work style | Positive response rate for employee engagement*8 | - | ||||

| Empowering diverse talents for personal fulfillment | Presenteeism performance Level*9 | 85% | Aisin Corporation (parent) | |||

| Respecting diversity and growing together | A work environment where diverse professionals can thrive | Positive response rate for an environment that empowers employees*10 | - | Consolidated |

|

|

| Ratio of female managers*11 | 4.5%*12 | Domestic group companies | ||||

| Laying a solid management foundation | Safety | A culture that prioritizes safety | Number of serious accidents*13 | 0 | Consolidated |

|

| Compliance | Zero serious violations of laws and compliance policies | Positive response rate for ethics survey | 90% | |||

| Human rights | Zero serious violations of human rights | Human rights risk assessment survey implementation rate*14 | 100% | |||

| Human rights training implementation rate*15 | 100% | |||||

| Governance | Achieved enhanced management transparency and internal controls by transitioning the Board of Directors to a Monitoring Board structure, thereby separating oversight and execution | Ratio of female directors | 30% or more | Aisin Corporation |

Resource efficiency: sum of the waste discharge reduction rate and the rate of increase in waste recycled for use within the group

Cleantech: technological solutions that reduce environmental impact (e.g., renewable energy, efficiency improvements, resource recycling)

Contribution CO2 emission reduction: cuts in CO2 emitted during product use achieved through performance enhancements

Assumption: Based on projections as of July 2025

Drive unit sales: sales volume of AT, CVT, HEV, PHEV, and eAxle units

MAU: Monthly Active Users, number of people who used the service at least once per month

Number of inventions: Total number of patent applications along with confidential and publicly disclosed instances of intellectual property

Positive response rate for employee engagement: Percentage of employee survey respondents who answered “I want to contribute to the company, feel loyal, and am motivated to put in proactive effort”

Presenteeism performance level: Percentage of employees who felt they could perform at 80% or more of their capacity over the past month, with 100% representing performance achievable while healthy.

Positive response rate for an environment that empowers employees: Percentage of employees who responded in the employee survey that “There are opportunities to apply my skills and abilities, and a comfortable work environment is provided”

Manager: key position (section chief) and above

Target values were updated following the expansion of HR activities from the initial four companies (Aisin, Aisin Takaoka, Aisin Chemical, and ADVICS) to the entire domestic group.

Serious accidents: Defined as those involving fatalities

Human rights risk assessment survey implementation rate: (Number of companies conducting human rights risk surveys / Number of consolidated companies) × 100

Human rights training implementation rate: (Number of employees who received training on compliance and human rights / Number of consolidated employees) × 100

The following outlines the materiality (priority issues) through FY 2025, along with actual performance against KPIs and FY 2031 targets.

| Materiality (Priority Issues) | KPI | FY2025 actual | FY2031 target values | |

|---|---|---|---|---|

| Resolution of social issues through business activities |

|

Revenue ratio of products for growing domains that contribute to solving social issues (percentage) *16

Revenue in growing domains + HEV unit revenue Total revenue |

41% | 58% |

| Contributing to health and welfare Total number of users of products and services |

MAU:35,700 | MAU:183,400 | ||

|

Ratio of R&D expenses for growing domains | 63% | 80% | |

| Lifecycle CO2 emissions reduction rate | Enhancing Working Group Activities by Priority Category (Production, Raw Materials, Supplier Support, Logistics, Waste, CE, etc.) |

Reduction of 25% or more [vs FY2020] |

||

| Reduction rate of CO2 emissions from manufacturing [total, vs FY2014] | 22.4% | Reduction of 50% or more (1.386 million t-CO2 *17/year) | ||

| Foundational management support for activities |

|

Number of serious accidents | 0 | 0 |

| Rate of disabling injuries occurring | 0.25*18 | 0.05 | ||

| Ratio of female managers | 2.8%*19 | 6.0% | ||

| Job satisfaction (result of employee awareness survey; 5-point rating) |

3.3 points*19 | 4.0 points (Group, consolidated) |

||

| Number of serious violations of laws and ordinances *20 | 0 | 0 | ||

| Rate of compliance with guidelines through the formulation and rollout of Group-wide global guidelines for suppliers (including FY2031 carbon neutrality target of at least −25% [compared to FY2020]) |

Group/Global Notification to suppliers in five regions (US, China, Europe, India, Asia ex-China) |

100% |

FY2031 target for CO2 emissions from manufacturing (total): Calculated using benchmarks from the Seventh AISIN Consolidated Environmental Action Plan

Companies included in calculation of actual results: 12 Aisin Group companies managed under common metrics as of FY2025 (Aisin, Aisin Takaoka, Aisin Chemical, Aisin Light Metals, Aisin Development, Aisin Kiko, Aisin Sin’ei, Aisin Fukui, Hosei Brake Industry, ADVICS, Aisin Shiroki, Art Metal Industry)

Companies included in actual results calculation: Four major Aisin Group companies managed under common indicators as of FY2025 (Aisin, Aisin Takaoka, Aisin Chemical, ADVICS)

Serious violations of laws and ordinances: criminal acts violating major laws or acts ultimately leading to criminal penalties