Environment

Disclosures based on the Task Force on Climate-related Financial Disclosures (TCFD) recommendations

TCFD endorsement and disclosure

Aisin announced its endorsement of the TCFD recommendations in November 2019 and discloses information based thereon.

TCFD recommended disclosures and implementation status at Aisin

Governance

| Recommended disclosures | Status of Implementation |

|---|---|

| (a) Board oversight of climate-related risks and opportunities | Sharing medium-to-long-term sustainability challenges and setting policies and KPIs for the Sustainability Conference Strategy review, promotion, deliberation, and monitoring conducted at the Environmental Committee and CN/CE Promotion Council chaired by theChief Carbon Neutral Officer, based on top-level policies and KPIs Climate-related material issues submitted for deliberation or reporting through the Sustainability Conference are reviewed by the Board of Directors |

| (b) Management's role in assessing and managing climate-related risks and opportunities |

Strategy

| Recommended disclosure | Status | ||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (a) Short-, medium-, and long-term climate-related risks and opportunities identified by the organization |

Identified response to climate change as an urgent global concern and selected it as a material issues

Extracted short-, medium-, and long-term transition and physical risks, as well as opportunities for all Aisin businesses using 1.5℃ and 4℃ scenarios

Key risks and opportunities

|

||||||||||||||||||||||||||||||||

| (b) Impact of climate-related risks and opportunities on operations, strategy, and financial plans | |||||||||||||||||||||||||||||||||

| (c) Resilience of the organization's strategy under different climate-related scenarios, including a 2℃ or lower scenario |

Risk management

| Recommended disclosure | Status |

|---|---|

| (a) Process for identifying and assessing climate risk | Identification, isolation, and review of individual risks affecting the Company by the Risk Management Committee (twice/year) Climate risk is prioritized as top priority and is regularly monitored and managed by the Environmental Committee, etc. |

| (b) Organizational processes for managing climate risk | |

| (c) Integration of processes for identifying, assessing, and managing climate- risk into companywide risk management system |

Indicators and targets

| Recommended disclosure | Status |

|---|---|

| (a) Disclosure of metrics used by the organization to assess climate-related risks and opportunities in line with its strategy and risk management |

In FY2022, declared goals of CO2 carbon neutrality of manufacturing operations by FY2036 and carbon neutrality by FY2051

Set decarbonization metrics based on materiality issues.

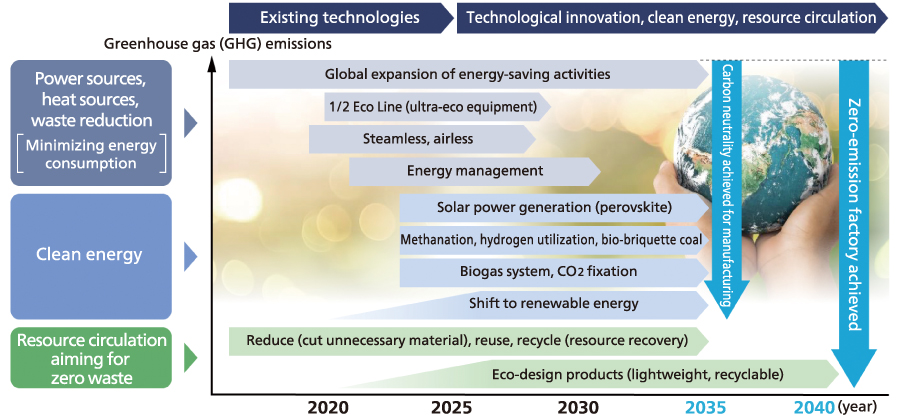

Climate initiatives advanced according to three thematic pillars: power sources, heat sources and waste reduction, clean energy, and aspirationally zero-waste resource circulation.

[Goals] FY2036: CO2 carbon neutrality of manufacturing operations FY2051: Total carbon neutrality[Indicators (FY2031) *SBTi Certified]

[Achievements (FY2025)]

|

| (b) Disclosure of Scope 1, 2, and 3 greenhouse gas emissions and associated risks | |

| (c) Targets and performance metrics used by the organization to manage climate risk and opportunity |

Governance

Aisin shares medium-to-long-term sustainability challenges and sets policies and KPIs under the auspices of its Sustainability Conference. In accordance with these high-level policies and KPIs, the Company regularly convenes the Environmental Committee and the CN/CE Promotion Council to discuss, advance, review, and monitor strategies for environmental infrastructure development, decarbonization, resource circulation, and harmonizing with nature, leading to agile decision-making.

Moreover, climate-related material issues submitted for deliberation or reported through the Sustainability Conference are reviewed by the Board of Directors. Where necessary, business strategies and plans are revised to optimize management strategy.

| Convening body | Role | Key attendees |

|---|---|---|

| Environmental Committee | Deliberation and deployment of fundamental environmental policies based on higher-level policies Monitoring to ensure proper execution of environmental-related operations and minimize risks |

Group 13 Companies President Executive officer in charge of environmental matters |

| CN/CE Promotion Council | Strategic review and promotion of decarbonization, resource circulation, and harmony with nature | Group 13 Companies Environmental Officer |

Strategy

Aisin recognizes the climate change countermeasures as an urgent global concern and has selected this as a materiality issues. To understand the impact of climate change on our business and identify climate-related risks and opportunities, we conducted analyses using the scenarios below.

Analysis scope and scenario setting

Analysis scope

Locations: all Aisin Group locations

Businesses: all (powertrain, driving safety, body, LBS, aftermarket, energy solutions)

Scenarios

Viewed from a short-, medium-, and long-term perspectives, transition and physical risks and opportunities became plainly obvious and impose a substantial impact on the business. Consequently, we have selected and analyzed the following two scenarios:

| 1.5℃ Scenario | 4℃ Scenario | |

|---|---|---|

| Societal outlook |

[Policy] Bold policies to reduce GHG emissions, such as carbon taxes and renewable energy promotion, are implemented [Technological innovation] Accelerated development and societal implementation of technologies for achieving energy efficiency and carbon capture, utilization, and storage (CCUS) [Market shifts] With the rapid shift toward electrification in the mobility market; products and services contributing to GHG reduction are enjoying market expansion |

[Global environment] Temperature rise exceeds 4℃, with significant negative effects on business operations caused by extreme weather events |

| Reference | IEA World Energy Outlook (NZE) Automotive industry scenarios | IPCC AR6 SSP5-8.5 |

| Related risks | Transition risks | Physical risks |

Identification of risk and opportunity

We identified all potential risks and opportunities, conducting detailed analysis particularly for items with high-risk concerns.

| Category | Risk/opportunity type | Impact stage | Impact on Aisin | Time horizon: short/medium/long | Financial impact: small/medium/large | Future actions |

|---|---|---|---|---|---|---|

| Transition risks | Market | Procurement | Increased demand for low-carbon raw materials and rising procurement costs due to surging prices of essential materials | Medium | Large | Reduction of raw material usage through weight reduction and material substitution during product design Reduction of raw material purchases through promotion of the circular economy |

| New regulations | Direct operation | Increased costs from carbon taxes and other policies as well as the adoption of renewable energy | Medium | Large | Promotion of energy-saving measures to minimize energy usage Introduction of renewable energy suited to regional characteristics | |

| New regulations | Product demand | Progress with electrification increases demand for electric vehicle components while reducing demand for ICE vehicle parts | Medium | Large | Shift of product portfolio toward electric vehicles in anticipation of increased electrification rate for powertrain unit sales by 2030 Strengthened sales expansion for energy solutions and products that contribute to carbon neutrality through electrification of mobility, including a wide range of items including high-efficiency, compact electric units, cooperative regenerative braking systems, thermal management systems, and aerodynamic devices | |

| Physical risk | Acute | Direct operation | Supply chain disruptions and temporary production stoppages during disasters caused by increasingly frequent and severe weather-related disasters (heavy rain, typhoons, floods, etc.) | Short | Medium | Establishment of standards for action and rules that apply during extreme weather events Enhancement of BCP for purchasing logistics Identification and regular monitoring of exposed locations Formulation and promulgation of flood countermeasure plans |

| Opportunity | Product demand | Products and services | Increased demand for electric vehicle products driven by electrification progress | Medium | Large | Early market introduction of electric units with better energy performance through high efficiency and miniaturization Cost reduction through standardization of currently model-specific units and reduced use of materials Improved EV range through evolution of cooperative regenerative braking systems Expanded production capacity for related products |

| New business creation driven by growing demand for CO2-reducing products and services | Medium | Medium | Market launch and share capture for perovskite solar cells Sales of bio-briquette coal derived from coconut shells Commercialization of technology to fix CO2 as calcium carbonate | |||

| Expanding demand for energy-saving and low-carbon-emission products | Medium | Medium | Raising efficiency further and expanding sales of the Ene-Farm home-use fuel cell cogeneration system, which contributes to enhanced resilience through high-efficiency, stable energy supply and independent power generation during outages Promoting decarbonization initiatives in collaboration with local governments to contribute to urban development | |||

| Resource efficiency | Direct operations | Energy efficiency gains reduce energy consumption and cut energy procurement costs | Medium | Large | Energy savings achieved through thorough implementation of power sources, heat sources, and waste reduction Development of innovative production technologies Clean energy transition through CO2 capture and utilization (e.g., through methanation) and the introduction of bio-briquette coal |

Timeframe – short: through FY2025, medium: through FY2030, long: through FY2050

Financial impact – large: ¥10 billion or more, medium: ¥1 billion through ¥10 billion *Minor financial impacts excluded from disclosure

Risk management

To minimize damage and ensure business continuity in a rapidly evolving business environment, the Risk Management Committee identifies and isolates risks affecting our Group. Among these, climate change risk is positioned as the top priority and regularly monitored and managed through the Environmental Committee and other channels.

Moreover, we review and revise planned countermeasures in accordance with global regulations, stakeholder dialogue, external assessments like Carbon Disclosure Project (CDP), and customer trends.

At the same time, growing demand for electrification and other products and services that contribute to CO2 reduction represents an opportunity for the Company. By integrating this into our management and business strategies, we will further enhance our corporate value.

Indicators and targets

Aisin declared its commitment to achieving carbon neutrality with regard to CO2 production by FY2036 and total carbon neutrality by FY2051 in FY2022. Based on degree of materiality issues行動規範, we have set the following decarbonization indicators and targets.

To achieve these targets, we are undertaking various initiatives centered on three thematic pillars: power sources, heat sources and waste reduction, clean energy, and resource circulation ideally leading to zero waste.

For specific initiatives, please refer to the Environment: Key Initiatives section of this website.

| Goals (KGI) | Indicators (KPI) | FY2031 target values |

|---|---|---|

|

[Carbon neutrality (CN)] FY2036: Achieve CO2 CN from manufacturing FY2051: Achieve total CN |

Scope 1 & 2 emissions | Down 46.2% compared to FY2020 |

| Scope 3 emissions | 27.5% reduction compared to FY2020 |

Pathways to carbon neutrality

Steadily introducing renewable energy by leveraging regional characteristics